Swing trading is a popular trading strategy that involves capitalizing on short-term price movements in the financial markets. Unlike long-term investing, which focuses on buying and holding assets for the long term, swing trading aims to profit from price fluctuations over a period of days or weeks. In this article, we’ll explore the basics of swing trading and how you can use this strategy to maximize your profits.

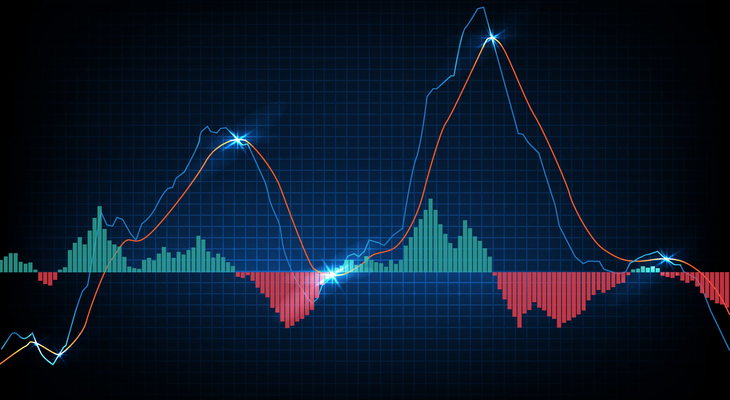

The first step in swing trading is to identify a trading opportunity. This can be done by analyzing charts and technical indicators to identify short-term trends in the market. For example, a swing trader might look for a stock that has recently experienced a pullback or correction and is now starting to trend upwards again. Once a trading opportunity has been identified, the swing trader will enter into a position with the goal of capturing short-term gains.

One of the key advantages of swing trading is that it allows traders to capture gains quickly. Unlike long-term investing, which requires patience and a long-term perspective, swing trading focuses on short-term gains that can be realized in a matter of days or weeks. This makes it an ideal strategy for traders who want to see results quickly and don’t want to tie up their capital for long periods of time.

Another advantage of swing trading is that it allows traders to profit from both bullish and bearish market conditions. Because swing traders are looking for short-term price movements, they can profit from both upward and downward price trends. This flexibility makes it easier for traders to adapt to changing market conditions and capitalize on opportunities as they arise.

To be successful at swing trading, it’s important to have a solid understanding of technical analysis. This involves analyzing charts and using technical indicators to identify trends and patterns in the market. By studying historical price data, swing traders can identify patterns and trends that can help them make better trading decisions.

Another key aspect of successful swing trading is risk management. Because swing trading involves short-term trades, it’s important to have a strict risk management plan in place to protect your capital. This can include setting stop-loss orders to limit potential losses and taking profits at predetermined levels to lock in gains.

One common mistake that new swing traders make is trying to predict market movements. While it’s important to analyze market trends and make informed trading decisions, it’s impossible to predict the future with 100% accuracy. Instead, successful swing traders focus on managing risk and taking advantage of short-term price movements as they occur.

Swing trading is a popular trading strategy that can be used to capitalize on short-term price movements in the financial markets. By identifying trading opportunities, using technical analysis to make informed trading decisions, and managing risk, swing traders can maximize their profits and take advantage of both bullish and bearish market conditions. However, as with any trading strategy, it’s important to have a solid understanding of the markets and to practice strict risk management to protect your capital which is similar to how most businesses operate when faced with decisions and stressful situations.

If you’re interested in swing trading, take the time to study technical analysis, develop a trading plan, and practice with a demo account before risking real capital. With the right knowledge and skills, swing trading can be a powerful tool for maximizing your profits in the financial markets. Looking for a community that can help take your swing trading to the next level? Check out WealthPress on Facebook and all of their content which can definitely send you in the right direction. Cheers!